How to Group Taxes

This article describes the process for grouping taxes into a tax/fee group.

Tax/fee groups are applied to individual products to ensure those products are taxed at the correct total tax rate. The total tax rate MAY be comprised of multiple taxes (state sales tax, county tax, etc.) that need to be grouped together and applied to the product.

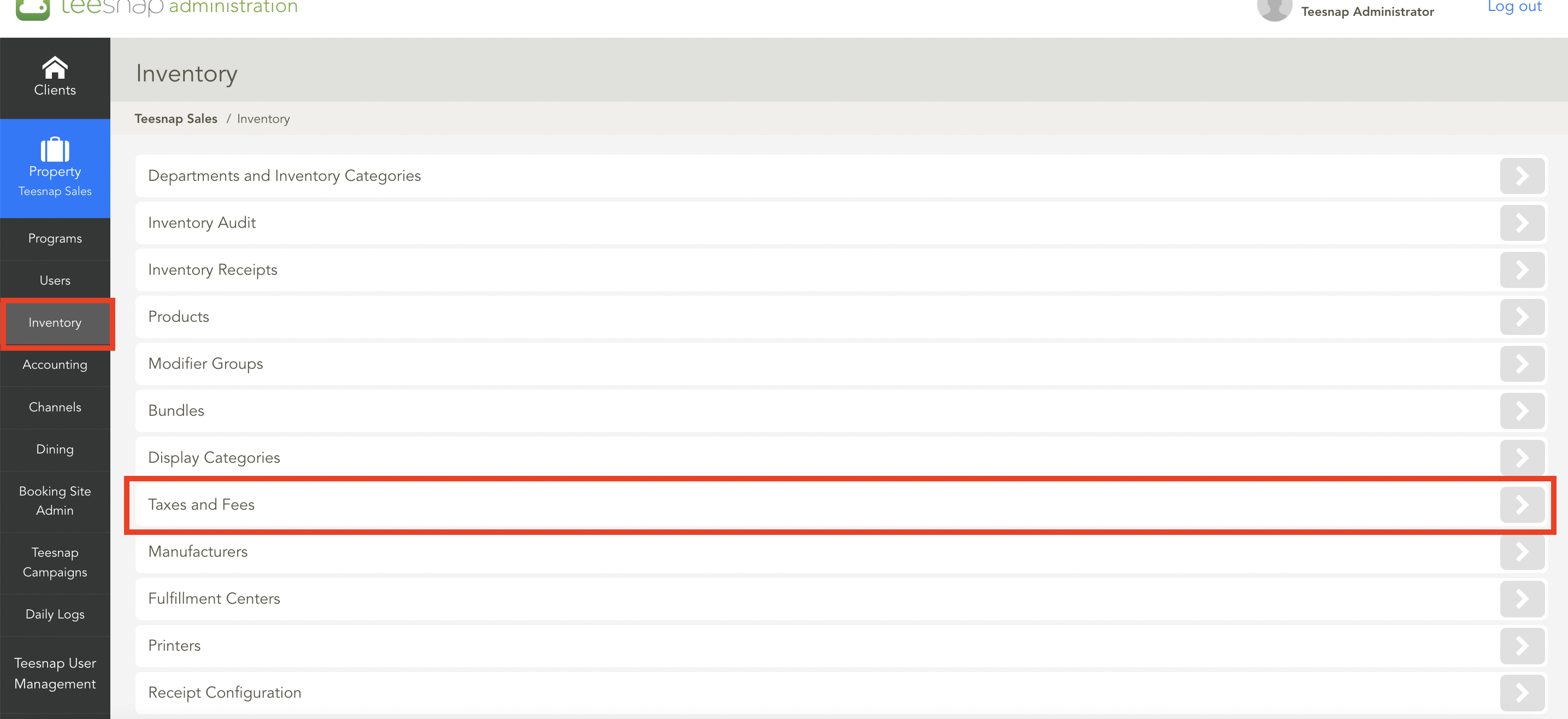

To group taxes into a tax/fee group, log into the Teesnap Admin Portal at admin.teesnap.com. Go to Inventory then Taxes and Fees.

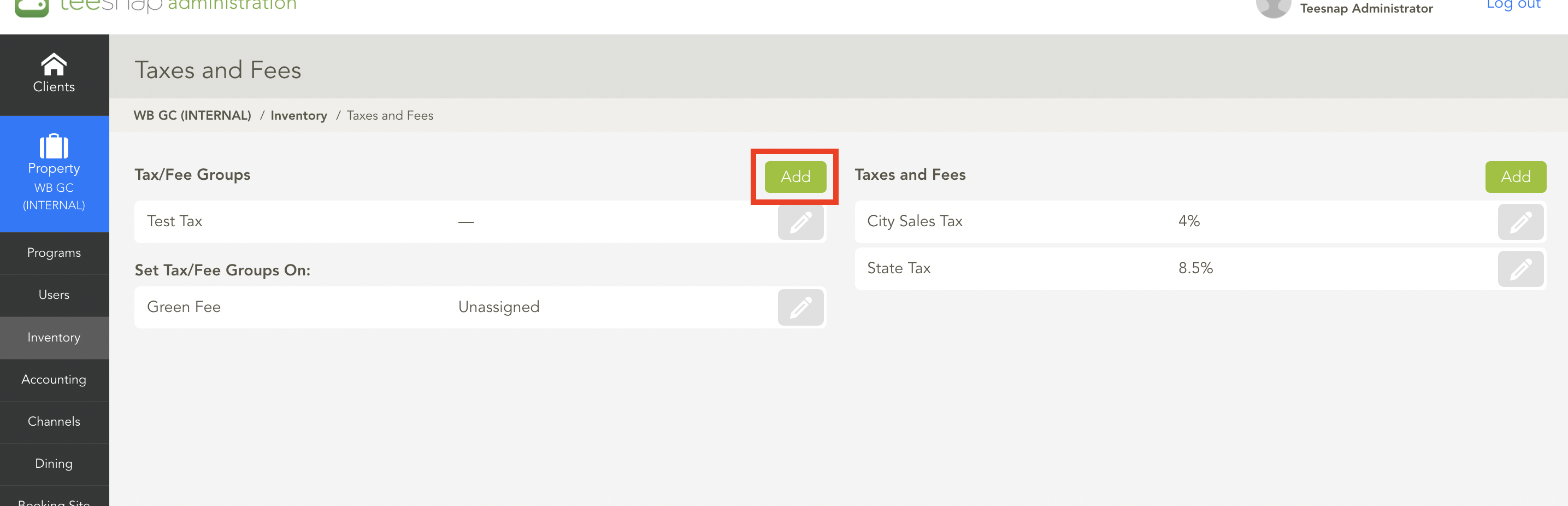

To create a new group of taxes, click Add to the right of Tax/Fee Groups

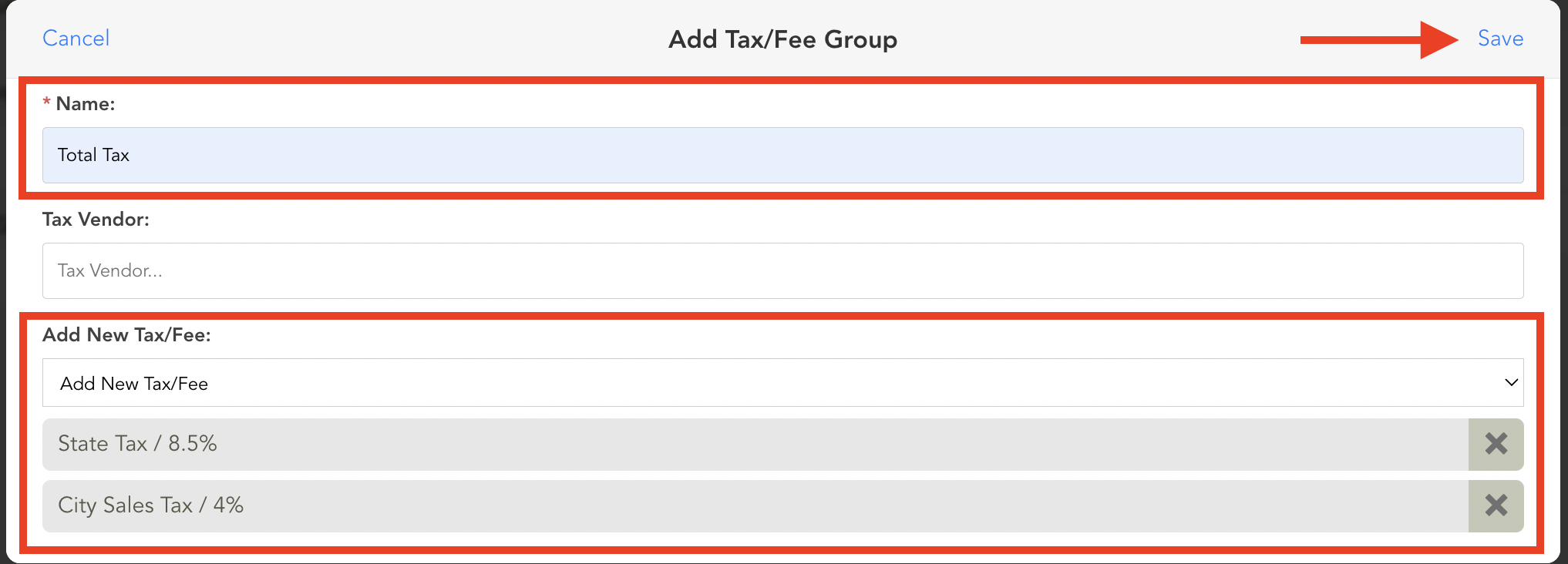

In the Add Tax/Fee Group window, fill in a name for the Tax Group and add a tax vendor if desired (not required). Click on the Add New Tax/Fee drop-down to select the applicable taxes to add to the group. When the applicable taxes have been added, and a name has been given to the tax/fee group, click Save to apply the changes.

If you have any questions, please do not hesitate to reach out to Teesnap Support by emailing us at support@teesnap.com or calling 844-458-1032

.png?width=240&height=55&name=Untitled%20design%20(86).png)