How to Tax Exempt a Sale

This article will provide a step-by-step guide to making an item tax-exempt.

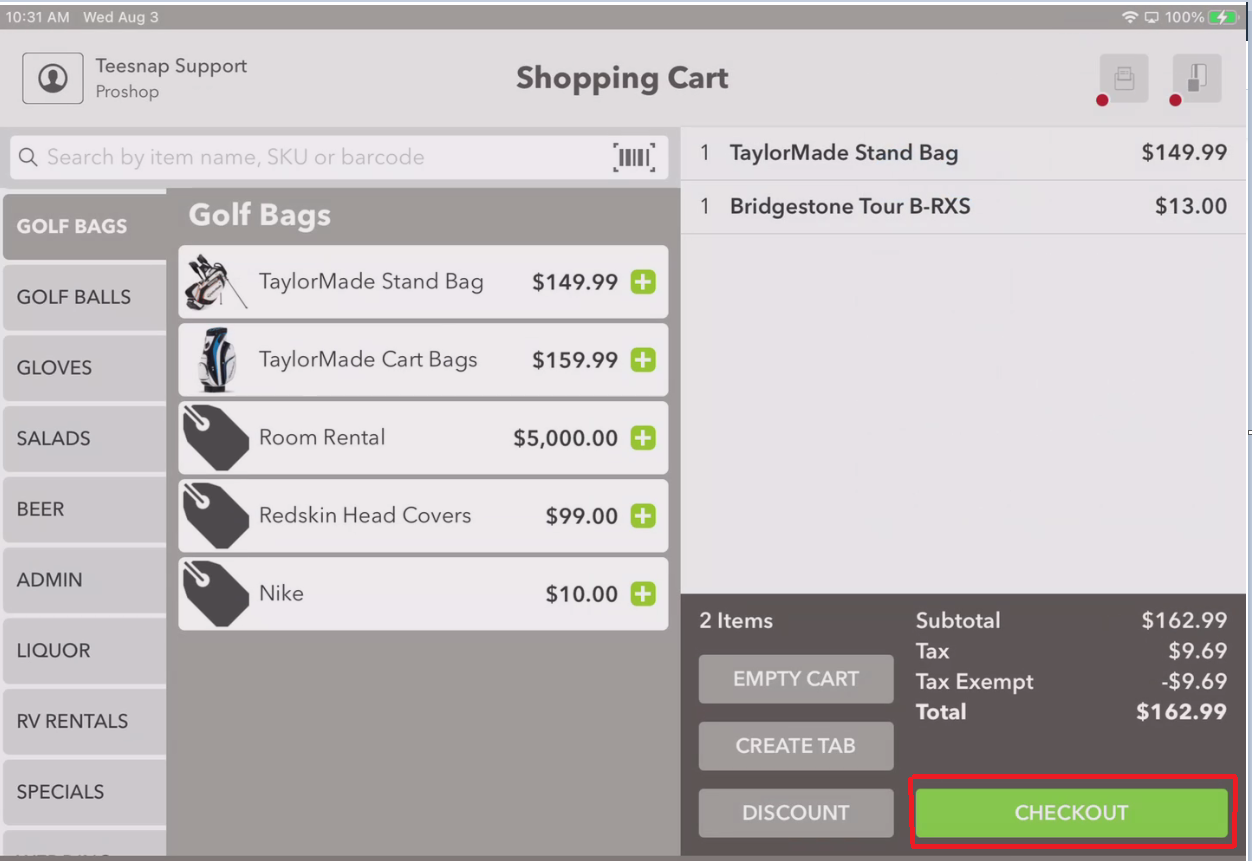

1. To make an item tax-exempt, add the item to your cart, and click "Checkout."

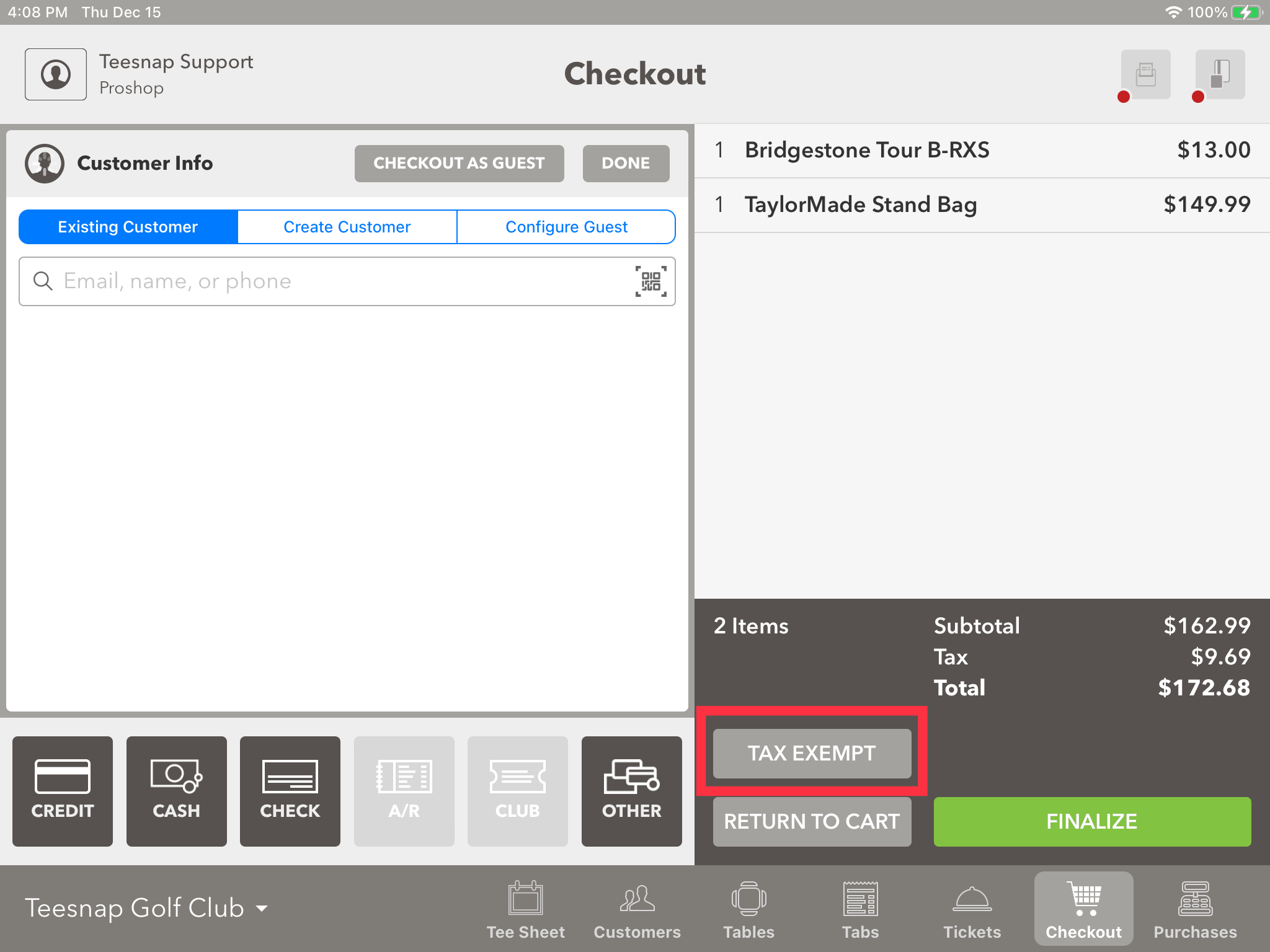

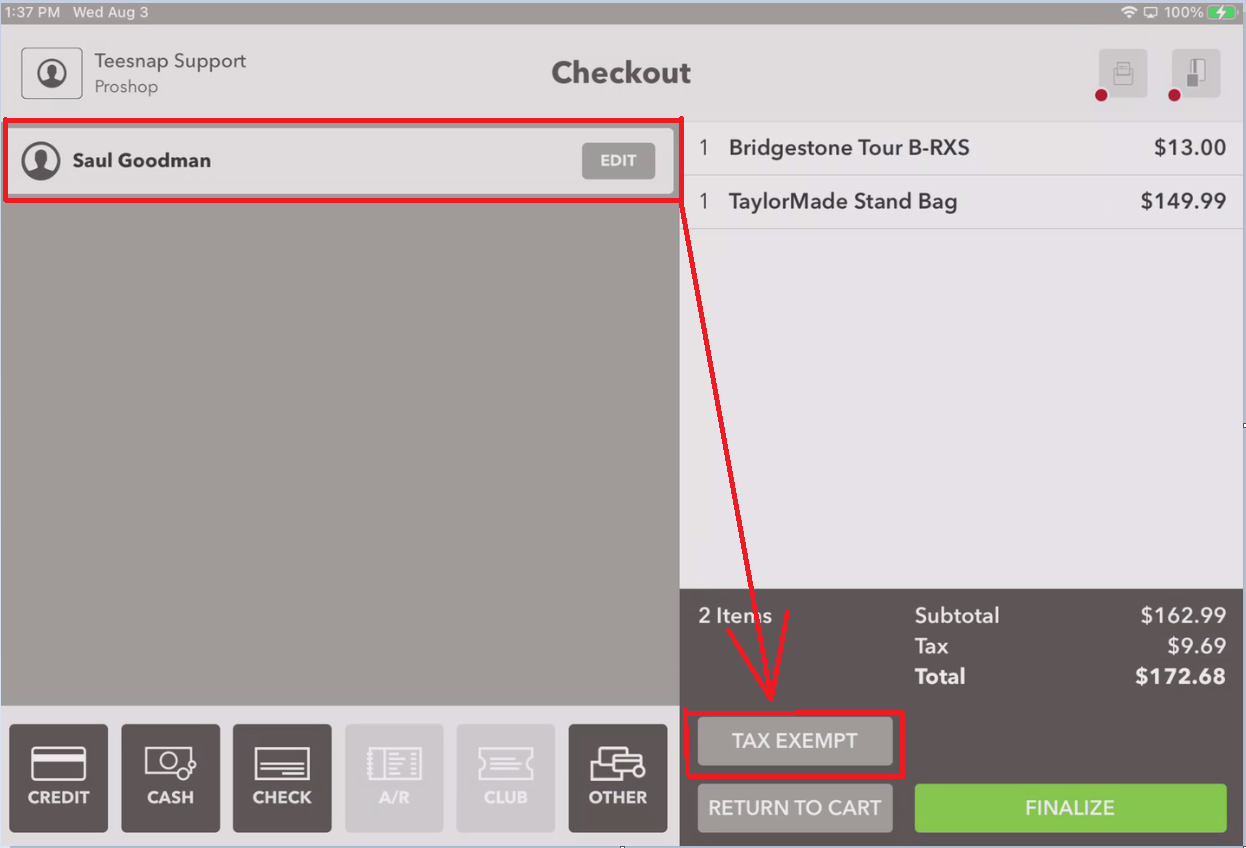

2. Once on the checkout screen you will see a button called "Tax Exempt."

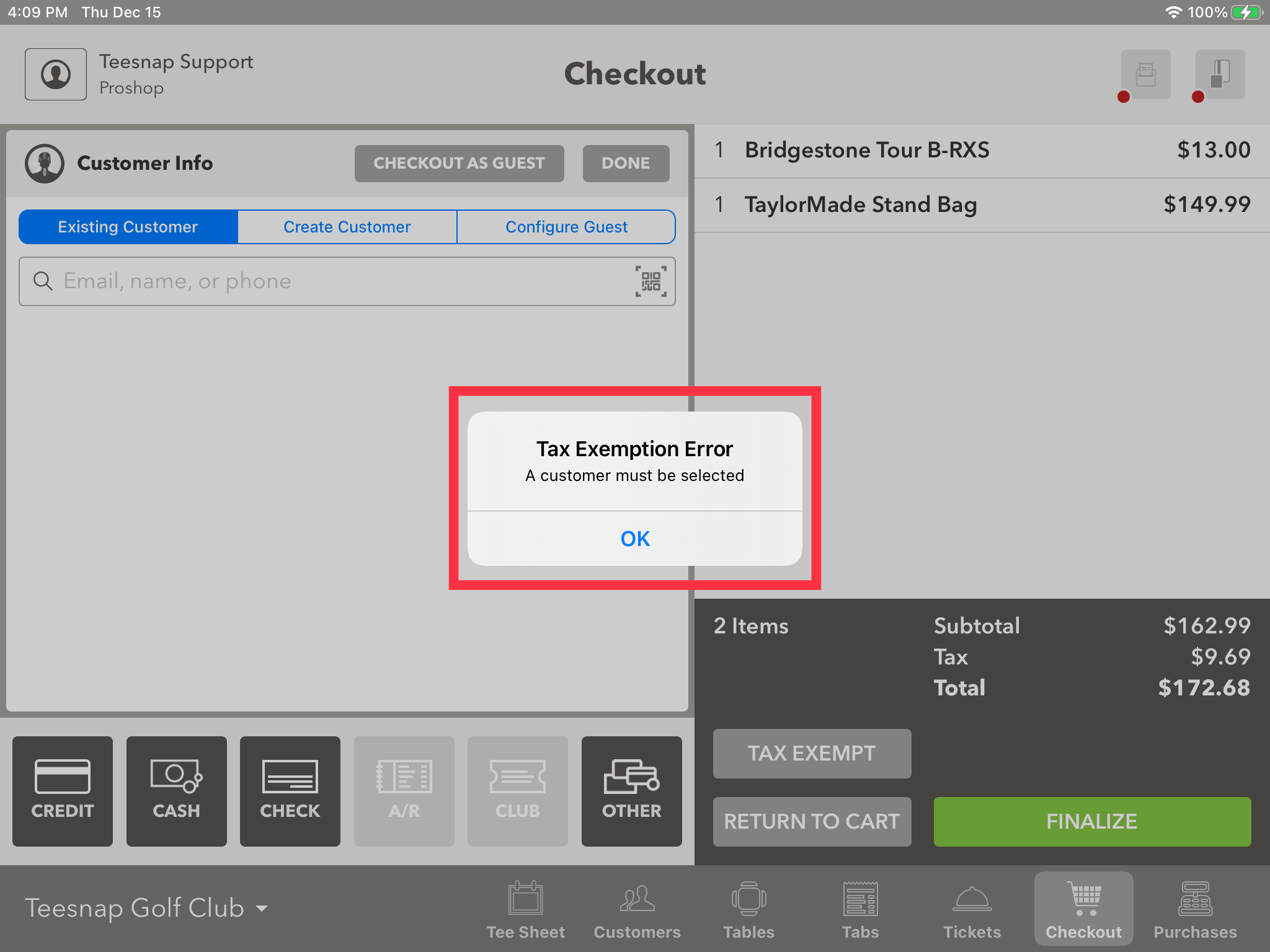

3. If you click on the tax-exempt button an error will come up. You'll need to select a customer first.

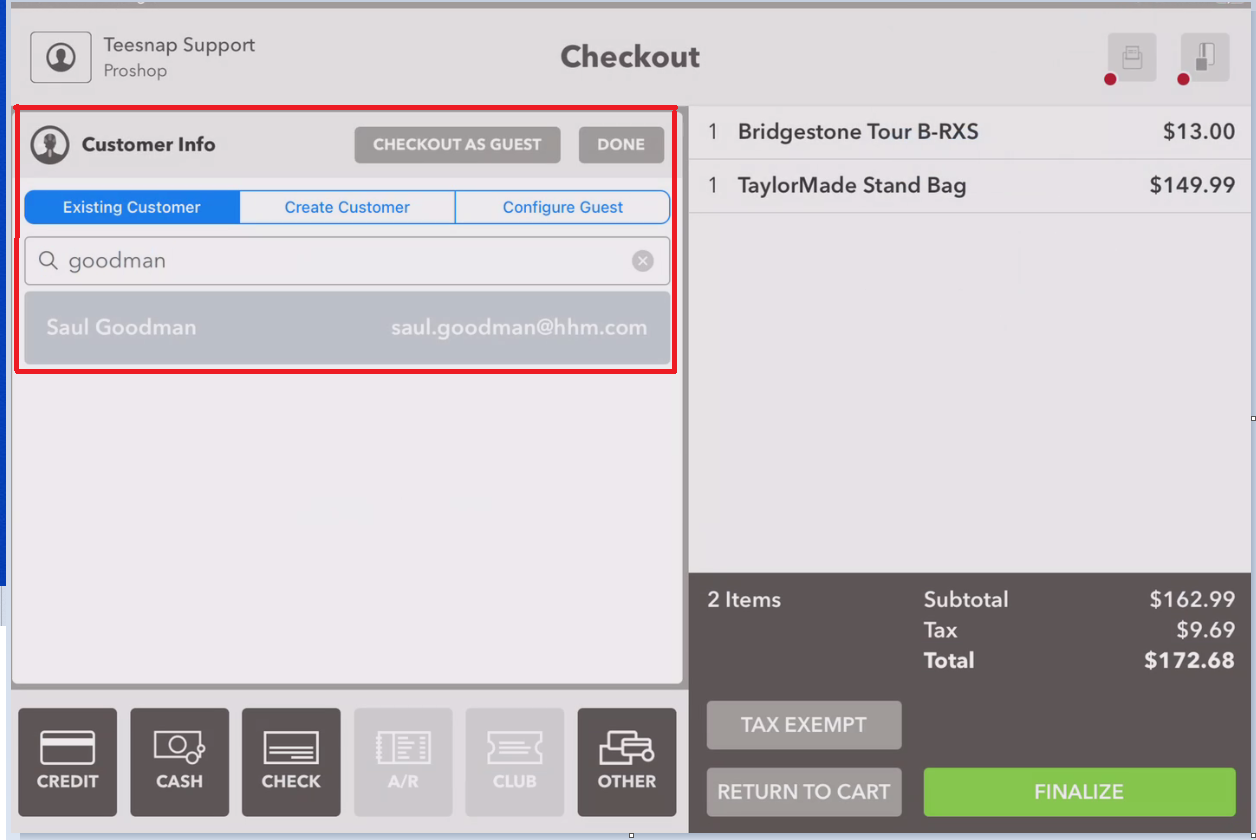

4. Search for a customer.

5. Once a customer has been assigned to the checkout screen, you can now select "Tax Exempt."

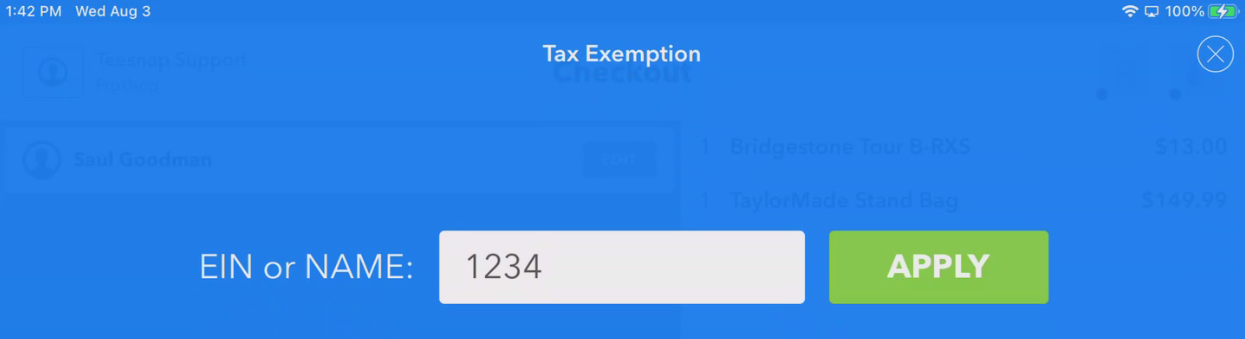

6. Enter Name or EIN

7. Select "Apply"

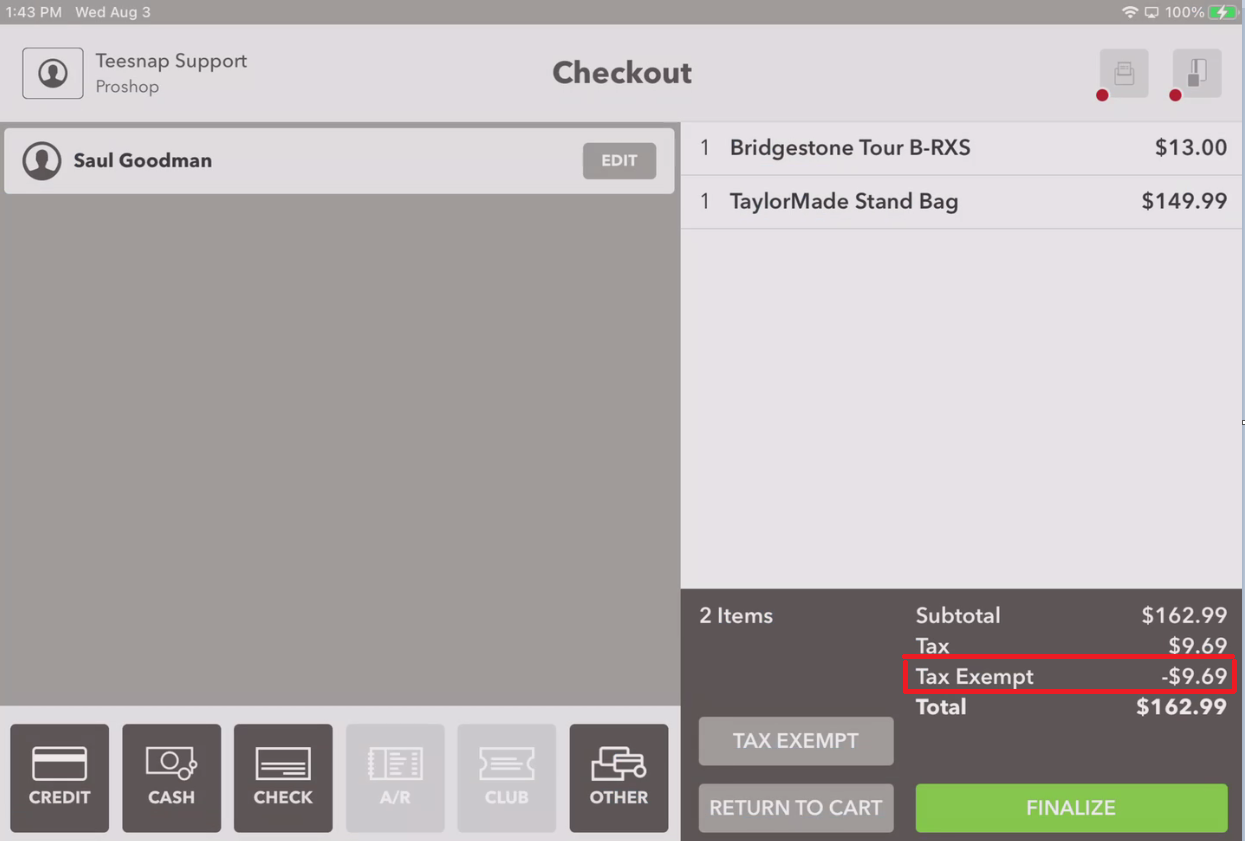

8. We can now see the item has been"Tax Exempt."

If you have any questions, please do not hesitate to reach out to Teesnap Support by emailing us at support@teesnap.com or calling 844-458-1032

.png?width=240&height=55&name=Untitled%20design%20(86).png)