What are Tax/Fee Groups?

This article explains the purpose of Tax/Fee Groups.

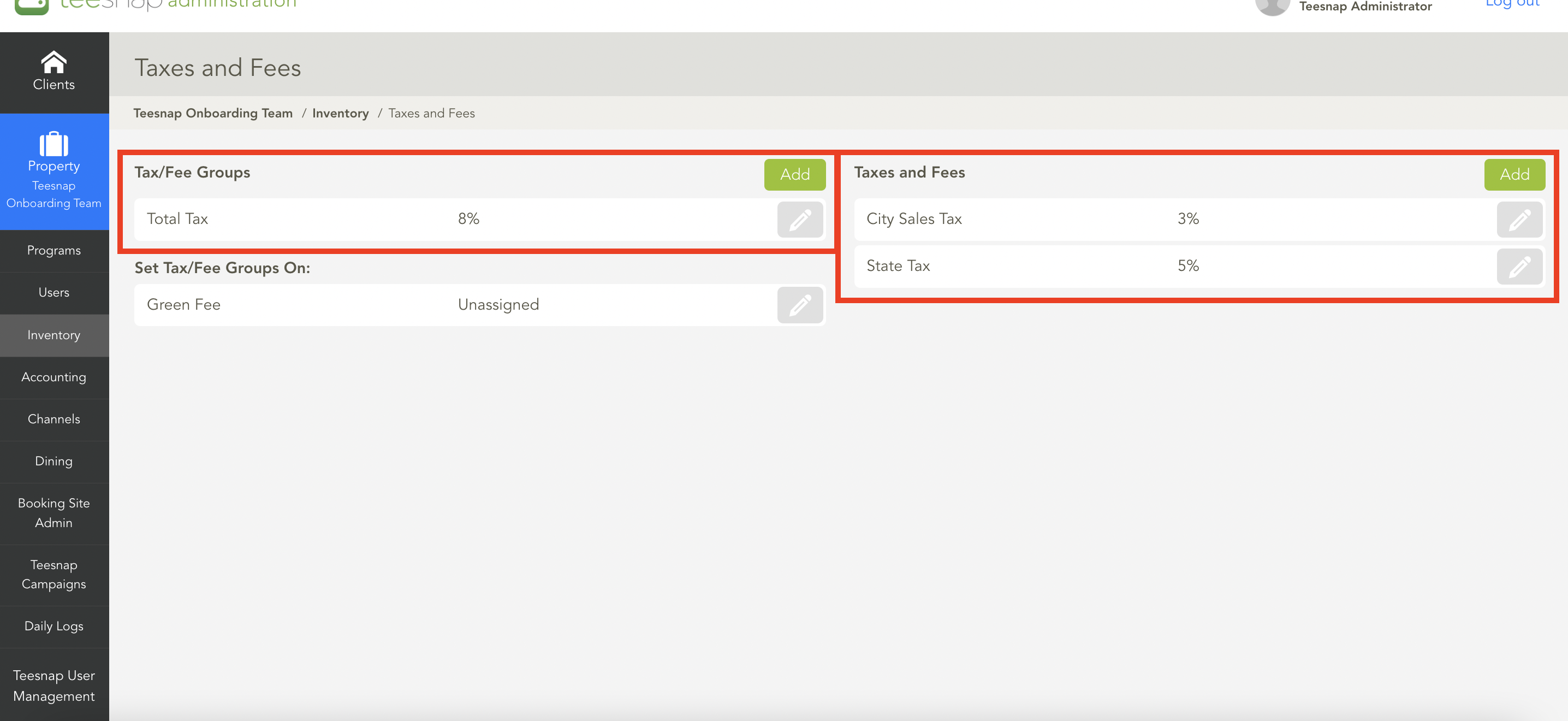

Tax Fee/Groups allow you to combine multiple separate taxes into one group that is assigned to a product. When the product is rung in, the total tax that is calculated, or fees added, is based on the sum of the taxes and fees that are a part of the tax/fee group.

To use an example, the tax/fee group below called "Total Tax" is comprised of two taxes, a Sales Tax of 6% and a City Sales Tax of 3%, for a total tax of 8%.

Any items that have been assigned to that Tax/Fee Group should now be taxed at that total rate of 8%.

If you have any questions, please do not hesitate to reach out to Teesnap Support by emailing us at support@teesnap.com or calling 844-458-1032

.png?width=240&height=55&name=Untitled%20design%20(86).png)